About

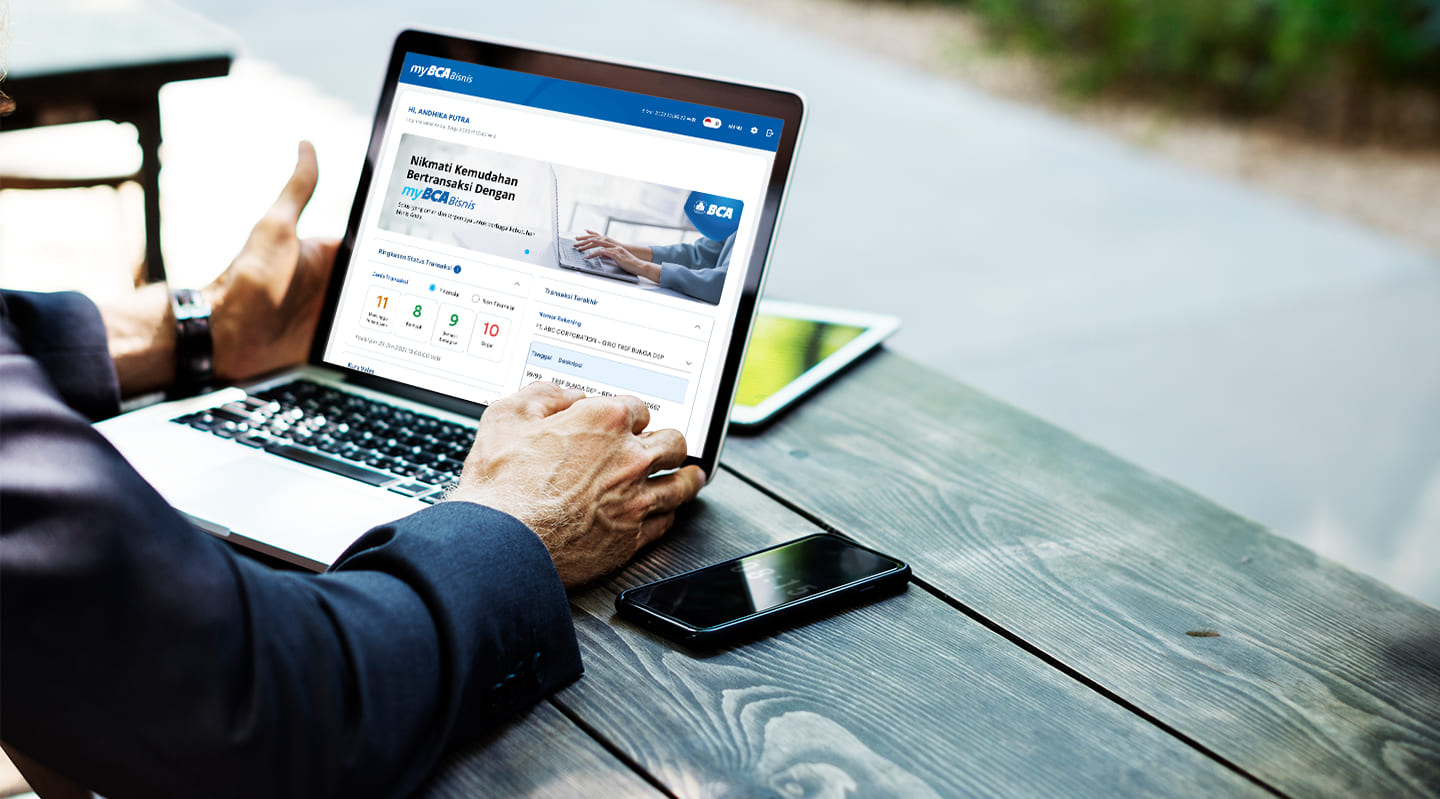

myBCA Bisnis is an internet banking service that can be accessed on various devices to perform transactions, authorizations, status checks, and address various cash management needs.

Benefits of myBCA Bisnis

- Easily perform both financial and non-financial transactions through myBCA Bisnis

- Enjoy convenient transactions on myBCA Bisnis from various devices, including mobile and desktop

- Enjoy the features in myBCA, designed to meet all your business needs

- If you have myBCA Bisnis H2H facilities, you can manage online banking transactions in real-time, directly from your own system.

Key Features

- Transaction Status Summary

Easily monitor transaction activity and status information, and authorize transactions within a unified interface - Account Informastion

Access balance information, account type, branch name, and other account details

- Account Statement

A feature to view debit or credit transactions, or both, for each account registered on MBB. Account Transactions can be downloaded individually or for multiple accounts at oncee-Statement -

e-Statement

A feature to download monthly account activity information, Customer Portfolio Reports, and Withholding Tax Certificates in softcopy via MBB, based on the selected period -

Credit Card

View and download information, transactions, and credit card bills registered on myBCA Bisnis -

Transfer to Your BCA Accounts

Features for making transfers to your own BCA account or other accounts. Currencies that can be traded are IDR, USD, SGD, HKD, AUD, EUR, GBP, JPY, and CNY. - BCA Virtual Account Transfer

Make a BCA Virtual Account transfers in Rupiah for an assignable effective date - Beneficiary List

A feature to register/change/delete beneficiary accounts, either individually or in bulk, for transfers to BCA accounts, Other Domestic Banks, BCA Virtual Accounts, and and Interbank Foreign Exchange. In addition, the Customer can also manage access rights for each account number. - Payroll

Make bulk salary payments for company employees to BCA accounts or other bank accounts (LLG/RTGS) - Payment & Top Up

Make various types of payments such as Telkom, Postpaid, State Revenue, PLN, BPJS Health, Water, Internet & Cable TV, Insurance, Loans, BCA Credit Cards & Other Banks, Loans, PBB, BPJS TK, Other Local Taxes. - Bulk Transfer

A feature for fund transfers in bulk to BCA accounts or other banks (LLG/RTGS) both domestic (LLG/RTGS) and foreign (OR), through file upload. The Customer can choose the authorization type, either authorizing the entire file at once (bulk authorization) or authorizing a specific part of the file (individual authorization). In addition, the Customer can also access supporting information about a transaction, such as detailed payment data sent to the beneficiary via email using the Remittance Advice function - Funds Transfer to BCA Account (Forex)

A feature that can be used for foreign currency fund transfers to the Customer’s own BCA account or other BCA accounts. Currencies available are USD, SGD, HKD, AUD, EUR, GBP, JPY, CNY - Bulk Payment

A feature to make various types of payments in bulk via file upload, including Telkom, BPJS Health, Mobile Phone, Credit Card & Paylater, Internet & Cable TV, and Water bill payments - Credit Facility Information

Inquire about facility data and loan details specific to myBCA Bisnis Borrowers - SCF Information – Payable Finance & Factoring

Access information regarding relationships and limits related to each ID program within Supply Chain Finance (SCF) - Transaction Limit Information

You can view your current usage and remaining limits for various types of transactions, including the Company Daily Limit, Account Limit, User Releaser Limit, and Direct Authorization Limit - Download Request Results

This feature allows you to download all files that the customer has requested from each feature in myBCA Bisnis - Business Debit Card

Easily manage financial activities, including cash inflows and outflows, with various features available from Deposit Cards, Petty Cash Cards, and Loyalty Cards - J-Valas

Access the J-Valas application without needing to log in again if you enter through myBCA Bisnis (single sign-on). myBCA Bisnis serves solely as an entry point to access the J-Valas app - Payee List

A feature to save/change/delete customer numbers for various types of payments and top-ups, either individually or in bulk, via file upload - BCA Virtual Account

Create a virtual account number by uploading customer data files and download the successfully created customer data. The virtual account number is a method for customers to pay their bills - BCA Virtual Account Report

Obtain transaction reports for payments made to customer virtual account numbers using this feature - Sweep Instruction

View the Sweep instruction that have been registered with BCA. The Sweep service enables automatic or scheduled transfer of balances in customer accounts based on the customer’s settings - Sweep Execution Result

This feature allows you to view the results of the sweep executions for the customer’s sweep instructions - Invoice Upload – Payable Finance & Factoring

You can add or delete invoices in bulk through file upload. This transaction is conducted by the Principal, meaning the Seller in the Payable Finance scheme or the Buyer in the Factoring scheme - Invoice Management – Payable Finance & Factoring

Inquire about invoice data that has been uploaded by the Principal. Invoice management allows you to initiate transactions such as Pay Invoice, Change Invoice, Delete Invoice, Loan Application, and Auto Invoice Payment - SCF Loans – Payable Finance & Factoring

View a list of loans associated with either a Principal or Counterparty within a program. Perform loan inquiries and initiate loan repayment transactions by the Counterparty (in the Payable Finance scheme) and Principal (in the Factoring scheme) - Credit Note – Payable Finance

Credit memos are features provided by sellers to buyers for invoice payments within a program. Customers can upload and manage credit memos with options to accept, reject, or delete them. - Cancel Post Dated Transaction – Payable Finance, Reverse Factoring, Receivable Finance

A feature to cancel transactions that have been scheduled but have not been processed - Host-to-Host (H2H)

Facilities for business customers to conduct online and real-time banking transactions from the customer's internal system with or without authorization through myBCA Bisnis. The following are MBB features that can be accessed via H2H MBB: e-Billing, Bulk Transfer, Payroll, Bulk Payment, Remittance Advice, SCF Report, SCF Invoice Upload, MT940 Report (H2H & SWIFT), Upload & Report Business Cards, and Bulk Collection. - Credit Payment

This feature allows borrowers to view their loan payment schedules and make loan payments. - Credit Statement

This feature enables borrowers to view the transaction history for specific loan account numbers. The type of credit facility applicable for credit statement is Time Loan Increasing Notes. - Credit Document

This feature provides borrowers with access to the latest kredit documents, which include the SPPK (Notice of Kredit Granting) and SPPJ (Notice of Term Extension) related to their accounts - Bank Guarantee

The Customer can make an inquiry or download information about previous Bank Guarantee applications, request the issuance of a Bank Guarantee and/or amendment of a Bank Guarantee previously issued by BCA - Supply Chain Finance Report

A feature that can be used by customers (principals and counterparties) to access reports related to invoices, loans, credit notes, and SCF facility information - Loan Facility Payment

A feature that can be used by debtors to carry out credit facility payments before/on/after the loan payment schedule - Loan Facility Transaction Inquiry

A feature that can be used by customers or debtors to view transaction history of certain loan accounts. The type of credit facility that can be accessed is Time Loan Increasing Notes. - Interbank Foreign Exchange Transfer

A feature for conducting foreign currency fund transfer transactions to other bank accounts (Outward Remittance / OR), both domestic and international, using funds from BCA accounts, in either IDR or foreign currency. For foreign currency funds, the transaction currency between the source account and the destination account must be the same. The following are the types of Outward Remittance transactions:

Transaction Types Description OR Value Today OR transactions where the effective date is the same as the transaction delivery date.

OR value date today is limited by the nominal limit and also the daily cut-off time according to each currency.

OR Full Amount OR transactions where the amount of money sent will be received in full by the recipient. Local Currency Transaction(LCT) Local Currency Transaction (LCT) is the settlement of bilateral trade transactions conducted by LCT customers in Indonesia and in partner countries using the Rupiah (IDR) or the local currency of the partner country. - Underlying Documents

A feature for uploading documents that serve as the underlying foreign exchange transactions of customers when the transactions executed have exceeded the threshold. The threshold accumulation calculation is performed automatically through the foreign exchange database system.